Examine This Report on Home Renovation Loan

This means you can borrow the funds to acquire the home and your planned restorations all in one lending.

The rate of interest on home renovation finances are typically less than individual finances, and there will certainly be an EIR, referred to as effective rates of interest, for every single improvement financing you take, which is prices along with the base rate of interest, such as the administration fee that a bank might bill.

Home Renovation Loan for Beginners

If you have actually just got a min: A renovation loan is a funding service that helps you better manage your cashflow. Its efficient rate of interest price is less than other common funding choices, such as charge card and personal car loan. Whether you have recently acquired a new home, making your home much more helpful for hybrid-work setups or developing a nursery to invite a brand-new baby, renovation plans could be on your mind and its time to make your plans a reality.

A 5-figure amount seems to be the norm, with substantial restorations going beyond S$ 100,000 for some. Below's when obtaining a restoration car loan can help to enhance your capital. A restoration finance is indicated just for the financing of remodellings of both new and existing homes. After the financing is authorized, a dealing with fee of 2% of authorized finance amount and insurance costs of 1% of accepted funding amount will be payable and deducted from the authorized funding amount.

Complying with that, the financing will certainly be disbursed to the specialists through Cashier's Order(s) (COs). While the optimum variety of COs to be released is 4, any extra carbon monoxide after the very first will certainly sustain a charge of S$ 5 and it will be subtracted from your designated car loan servicing account. Furthermore, costs would likewise be incurred in case of termination, pre-payment and late payment with the costs revealed in the table listed below.

The 5-Minute Rule for Home Renovation Loan

In addition, website check outs would be performed after the dispensation of the funding to make certain that the lending profits are utilized for the stated restoration functions as provided in the quotation. home renovation loan. Extremely typically, remodelling loans are contrasted to personal car loans yet there are some benefits to secure the previous if you require a finance specifically for home improvements

If a hybrid-work plan has currently become an irreversible attribute, it might be excellent to consider remodeling your home to develop a much more work-friendly atmosphere, enabling you to have actually a marked job space. Once again, a renovation financing might be a beneficial economic device to plug your capital space. However, remodelling finances do have an instead rigorous usage policy and it can just be used for renovations which are irreversible in nature.

If you locate on your own still needing help to fund your home furnishing, you can take up a DBS Personal funding or obtain all set cash money with DBS Cashline to pay for them. Among the greatest mistaken beliefs concerning improvement funding is the viewed high rates of interest as the released rate of interest is greater than individual loan.

Not known Details About Home Renovation Loan

In addition, you stand to enjoy a much more appealing rates of interest when you make environmentally-conscious decisions with the DBS Eco-aware Restoration Lending. To qualify, all you need to do is link to satisfy any type of 6 out of the 10 products that apply to you under the "Eco-aware Improvement Checklist" in the application type.

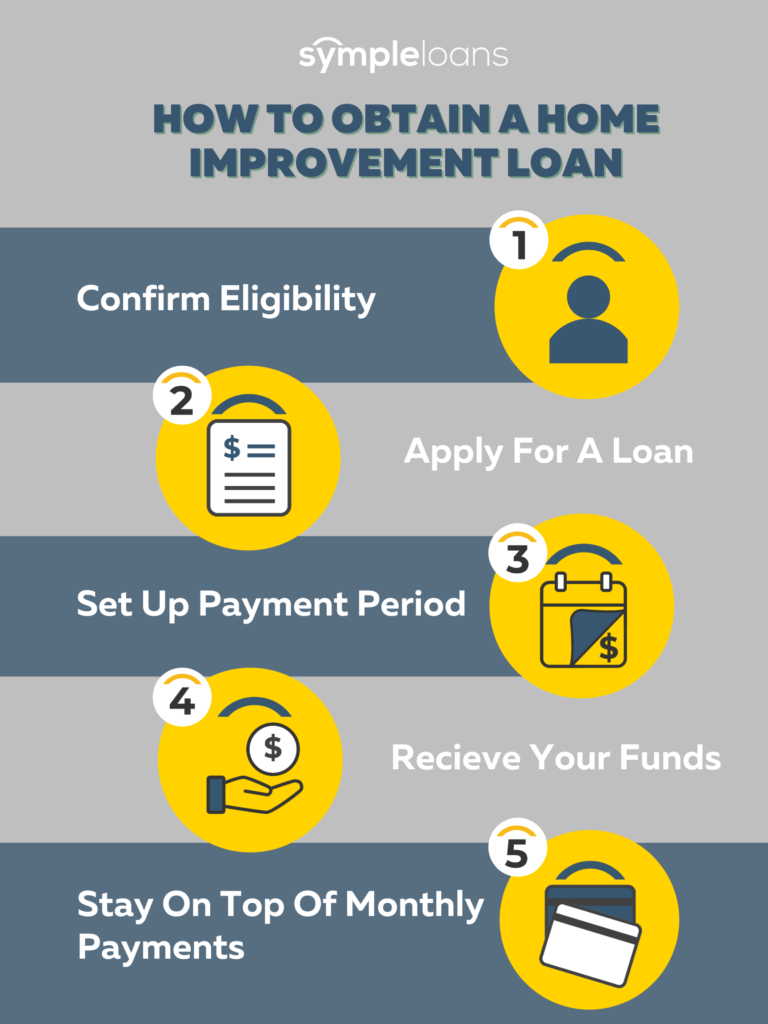

Or else, the steps are as complies with. For Solitary Candidates (Online Application) Step 1 Prepare the required papers for your renovation loan application: Scanned/ Digital billing or quotation authorized by professional and candidate(s) Income Documents Proof of Ownership (Forgoed if renovation is for property under DBS/POSB Home Financing) HDB or MCST Renovation License (for applicants that are proprietors of the assigned professional) Please keep in mind that each file dimension need to not go beyond 5MB and appropriate layouts are PDF, JPG or JPEG.

The Facts About Home Renovation Loan Uncovered

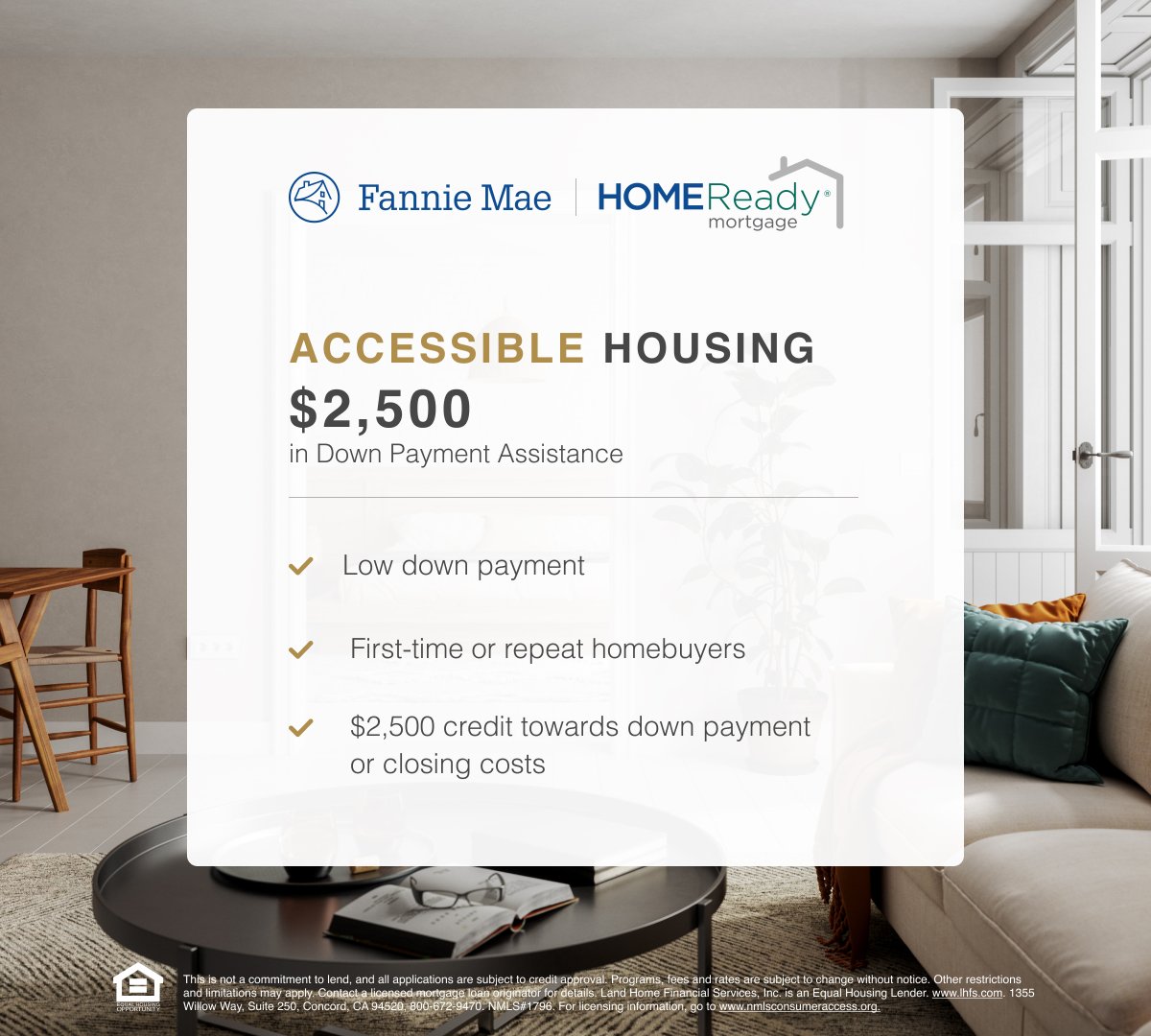

Implementing home renovations can have numerous positive results. You can raise the worth of your property, reduce energy costs, and improve your lifestyle. Obtaining the ideal home improvement can be done by using among the several home renovation lendings that are offered to Canadians. Also better, these funding alternatives are available at a few of the most effective financing prices.

The disadvantage is that many of these homes need updating, sometimes to the entire home. This can be a home equity funding, home line of credit rating, home refinancing, or other home finance options that can give the money required for those revamps.

Home renovations are possible through a home improvement funding or hop over to here an additional line of credit score. These kinds of loans can give the property owner the capacity to do a number of various things.